Do I have enough Life Assurance cover?

/It is understood that if you plan to purchase a property in Ireland, you will be required to have a Mortgage Protection policy in place. This policy is used to pay back the mortgage loan amount in the event of death.

Is Mortgage Protection enough life cover? Depending on your age and whether you have a family or dependents, then no, Mortgage Protection alone is regularly not enough.

Why would I need more Life Assurance cover? A salary coming into a household is used for bills, loans, savings, and other big life events. If this salary ceases in the event of death, a replacement will be needed to cover the shortfall. If you have a young family, you will need more cover as you will need any benefits to last for a longer time.

How much is enough? We tend to avoid thinking about losing our loved ones, let alone the financial consequences. There is more than one way to work out how much life cover you might need. A basic starting point is to multiply your gross salary or your household annual expenses by a factor of eight.

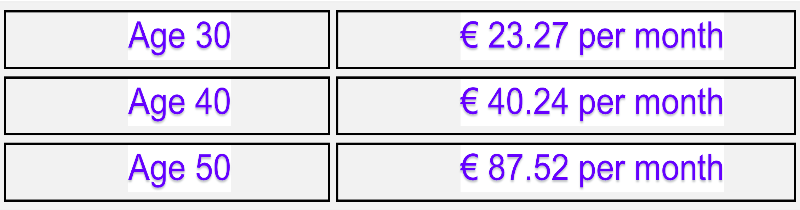

The following Dual Life Assurance quotations are an example of the cost for a couple who are non-smokers and with the option of conversion (this allows you to convert your policy before the term ends to a new policy without the need to provide medical evidence).

The term is for 10 years, and the cover is €250,000. The premiums below cover both lives and is dual cover (meaning the amount of €250,000 will be paid out for each individual life in the event of death).

Sample quotes December 2023

You may require less Life Assurance cover in the case where; your dependents are financially independent, you have death-in-service benefit through your job, you have substantial savings, or you have investments or a property which could provide an income or be sold.

It is beneficial to know that at various times throughout the year, life companies can offer special discounts on premiums to brokers. For example, one company is currently offering 6 months cashback on certain new protection policies.